How much money does the average 40 year old have in the bank?

From age 40: Save three times your annual salary. If you earn $ 50,000, you should plan $ 150,000 to save your retirement around 40.

Can I retire at 62 with 400k?

Contents

Yes, you can go back to 62 with four hundred thousand dollars. At age 62, an annuity provides a guaranteed level of income of $ 21,000 annually from the outset, for the remainder of the insurance’s life. … The longer you wait before starting your life annuity payment, the higher your income will be.

Can you retire at 62 with 500k? Yes, you can back up to $ 500k The short answer is yes – $ 500,000 is enough for some retirees. The question is how this will work out, and what conditions will do it good for you. With a source of income like social security, relatively low expenses, and a bit of luck, this is feasible.

How much savings should I have at 62?

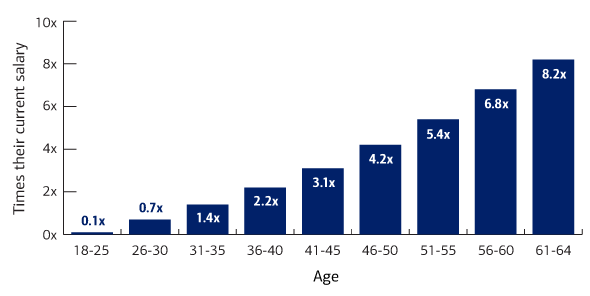

Those who retire at 62 (the earlier you can apply for Social Security) will have to save more to compensate for an additional five years without income. … Up to 50 years: six times your income. At age 60: Eight times your income. At age 67: Ten times your income.

How much does the average 64 year old have in savings?

The 2019 Fed survey found that Americans between the ages of 55 and 64 had an average savings account balance of $ 57,800.

How much money should I have saved by 62?

Conventional wisdom, according to AARP, says you should count on having a nest of $ 1 million to $ 1.5 million, or savings that are at 10-12 times your current income.

Can I retire at 60 with 400k?

It is pension in its basic form. However, if you hope to enjoy a comfortable retirement, you can estimate between £ 15,000 and £ 40,000 a year (or if you use target replacement rate as a measure, you will need between one-half and two-thirds of your pre-retirement annual income each). Year).

Is 500k enough to retire on at 60?

The short answer is yes – $ 500,000 is enough for some retirees. The question is how this will work out, and what conditions will do it good for you. With a source of income like social security, relatively low expenses, and a bit of luck, this is feasible.

What is the average 401k balance for a 60 year old?

| AGE | YEAR EMPLOYED | NO GREAT |

|---|---|---|

| 45 | 23 | $ 437,000.00 |

| 50 | 28 | $ 534,500.00 |

| 55 | 33 | $ 632,000.00 |

| 60 | 38 | $ 729,500.00 |

How much should a 62 year old retire?

This general rule of thumb refers to how much money you should withdraw from your savings each year to maintain an account balance that flows through your entire retirement income. As you can see, to live on $ 50,000 a year, you need savings of at least $ 1.25 million.

At what age do most people who retire actually retire?

Yes, the average retirement age is 61, but more than half of the workers (54%) plan to continue working at age 65. Many retirees are also returning to work. Some work part-time, others pursue a second career.

What is the average age a person retires?

The average age at which Americans say they plan to retire is 62. The younger investors are, the sooner they hope to retire.

Where should I be financially at 35?

At age 35, your net worth should be approximately 4x your annual expenditure. Alternatively, your net worth at age 35 should be at least 2X your annual income. Given the median household income of approximately $ 68,000 in 2021, the upper middle class household should have a net worth of approximately $ 136,000 or more.

How much should I save for retirement when I start at 35? To be able to retire comfortably, Fidelity Investments recommends that at age 30 you try to have your current salary and savings once and twice your salary for up to 35 years. Saving your last paycheck, the company noted.

How much money should you have saved at 35?

So, to answer the question, we believe that saving one and a half times your retirement income up to 35 years is a reasonable goal. It is an achievable goal for someone starting at the age of 25 to start saving. For example, a 35-year-old earning $ 60,000 would be on track if she saved about $ 60,000 to $ 90,000.

How much do most 35 year olds have saved for retirement?

| Median Retirement Account Balance by Age | |

|---|---|

| Age group | 401 (k) / IRA balance |

| 35-44 | $ 51,000 |

| 45-54 | $ 90,000 |

| 55-64 | $ 120,000 |

How much should a 35 year old have in 401k?

Average 401k balance at age 35-44 – $ 229,375; Average $ 111,416. If you have not already started maximizing your 401k by this age, then really start thinking about what changes you can make to get as close as possible to that $ 19,500 per year contribution. You do not want to lose out on years of compound interest.

How much should a 35 year old have in 401k?

Average 401k balance at age 35-44 – $ 229,375; Average $ 111,416. If you have not already started maximizing your 401k by this age, then really start thinking about what changes you can make to get as close as possible to that $ 19,500 per year contribution. You do not want to lose out on years of compound interest.

How much do most 35 year olds have saved for retirement?

The average 35-year-old also did not save $ 105,000. The median retirement account balance is $ 60,000 for the 35-44 age group, according to the Federal Reserve 2019 Survey of Consumer Finances. Many people in this age group build wealth through homeowners, with 61.4% owning a primary residence.

How much should I have in my 401k by age?

This is how many Fidelity experts recommend that you save for retirement at any age: Up to 30, you should have saved the equivalent of your salary. Up to 40 years, you should have saved three times your salary. By age 50, you should have saved six times your salary.

How much should you have in savings?

Having three to six months of spending is a general rule of thumb, but you can choose to save more. If you think it will take longer than six months to find a new job if you have lost your job, or if your income is erratic, then it may be wise to consider up to 12 months worth of expenses.

How much should I save on 40? At age 40, you should have saved a little over $ 175,000 if you were earning an average salary and followed the general guidelines that you should have saved about three times your salary at that time. … A good savings target depends not only on your salary, but also on your expenses and how much debt you owe.

Is it good to have $10000 in savings?

Compared to the statistical average and the majority of Americans, having $ 10,000 in savings is good and a great achievement. The sooner you reach this goal, the better it will be for your future financial goals and family if you decide to start one.

How much should a 30 year old have in savings?

At age 30, you should have saved close to $ 47,000, assuming you earn a relatively average salary. This target number is based on the rule of thumb that you should count on to save about a year’s salary from the time you enter your fourth decade.

Is it okay to have 10000 in the bank?

The Banking Secrecy Act is officially called the Monetary and Foreign Transaction Reporting Act, beginning in 1970. It states that banks must report all deposits (and withdrawals for that matter) that they receive over $ 10,000 to the Internal Revenue Service. For this they fill out the IRS Form 8300.

How much does the average 30 year old have in savings?

How much money did the average 30 year old save? If you actually saved $ 47,000 at age 30, congratulations! You are far ahead of your peers. According to the Federal Reserve 2019 Survey of Consumer Finance, the median retirement account balance for people younger than $ 35 is $ 13,000.

How much should a 30 year old save each month?

Many sources recommend saving 20% of your income every month. According to the popular 50/30/20 rule, you should reserve 50% of your budget for essentials like rent and food, 30% for discretionary expenses, and at least 20% for savings.

What should net worth be at 30?

Not Worth At Age 30 At age 30, your goal is to have an amount equal to half your salary in your retirement account. If you make $ 60,000 in your 20s, strive for a net worth of $ 30,000 up to 30 years. This milestone is made possible by savings and investments.

What is the average 401K balance for a 35 year old?

| AGE | Average 401K BALANCE | MEDIAN 401K BALANCE |

|---|---|---|

| 22-25 | $ 5,419 | $ 1,817 |

| 25-34 | $ 26,839 | $ 10,402 |

| 35-44 | $ 72,578 | $ 26,188 |

| 45-54 | $ 135,777 | $ 46,363 |

What is the average retirement savings for a 35-year-old? The median retirement account balance is $ 60,000 for the 35-44 age group, according to the Federal Reserve 2019 Survey of Consumer Finances. Many people in this age group build wealth through homeowners, with 61.4% owning a primary residence.

Comments are closed.